- #GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION UPDATE#

- #GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION FULL#

- #GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION PRO#

Businesses that conduct some of their operation in foreign currencies need to convert the amount to the accepted currency and disclose this. This means that an accountant must be accurate while depicting the financial status of a company in a financial report.

#GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION FULL#

This entails that accountants make full disclosure of every aspect of a company while compiling financial reports. This means the accountant must assume the business will have no end date. When an accountant values an asset in a financial report, it must assume the continuity of the business. Professionals must consistently practice the standards and procedures outlined in GAAP. This principle binds accountants to adhere to the regulations and standards of GAAP and also desist from irregularities in financial reporting. Also, the release of financial statements should align with the start and end date pertaining to them. This is also called principle of periodicity, it entails that financial entries should be distributed at the specific time assigned to them.

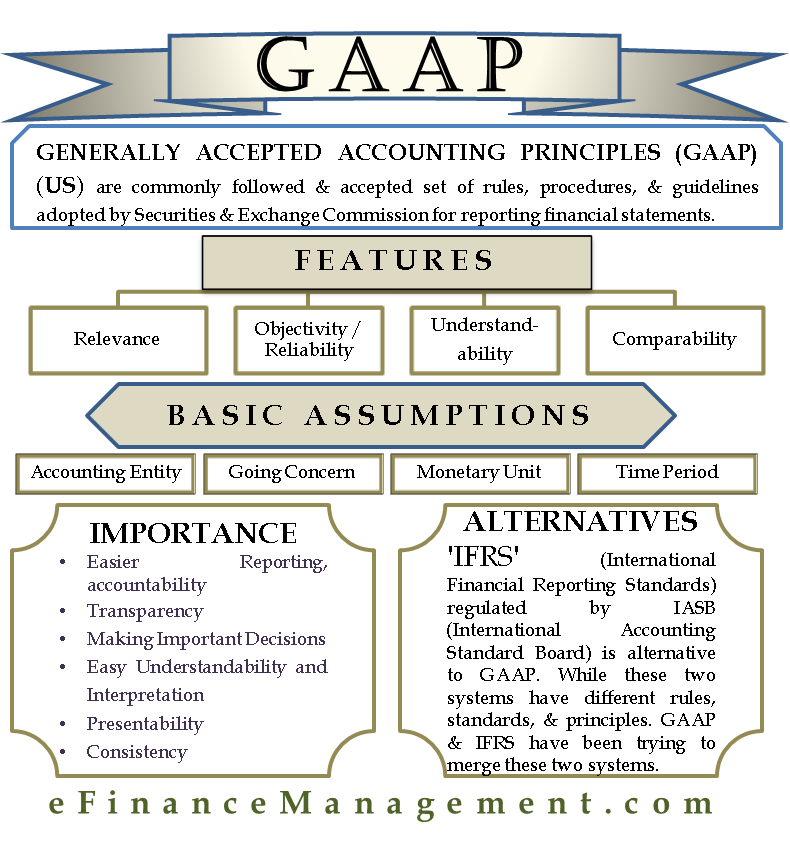

There are 10 general principles states in GAAP, they are the principles of GAAP ensure consistency in financial reports which makes it easier for investors to access useful and reliable financial information as compiled by accountants with ethical practices.

GAAP was designed to improve accounting practices especially when accountants compile financial statements. How are Generally Accepted Accounting Principles Used?

#GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION PRO#

IFRS standards and pro forma accounting are non-GAAP. The United States Securities and Exchange Commission (SEC) adopts these standards and accountants are mandated to follow these principles when arranging or collating financial statements.įinancial reporting must be tailored to reflect GAAP, otherwise, it might be unacceptable. Commonly accepted accounting practices were also included in the framework. GAAP is a standard framework that was developed by professionals in the accounting industry (Financial Accounting Standards Board or FASB). We want to tell everything to to everyone. This way, the end user can see how these numbers are calculated. When you're choosing what method to use, you have to state in your financial statements that this is the method I use and this is how we get the numbers or this is the percentage that I use or this is the percentage that I estimate. So, throughout this material, we will refer to different methods or different ways of doing things, procedures. These disclosures are often found in the footnotes of the statement. The full disclosure principle states that a company must report the details behind the financial statements that would impact users decisions. This just has to be in the same period that which we used it. So, just like in the revenue recognition principle tells us when we have to recognize revenue, the matching principle tells us when we have to recognize expense. This principle states that the company must record its expenses in the same period used to generate the revenue. The matching principle is pretty much the same as the revenue recognition principle except it's dealing with expense. This principle it's telling you when you have to recognize revenue when the product is delivered or the service rendered. So, I have rendered the product or the service and at the moment expected payment to be received from the customer. This principle states that revenue must be recognized one when the goods and services are provided to the customer. The second one is called the revenue recognition principle or rev-rec. What is the Revenue Recognition Principle? So, if you purchase a piece of land for ten thousand dollars, but it's actually valued at fifteen thousand dollars at the time of purchase, and you have it still five years later and it's appreciated up to twenty five thousand dollars, it's still going to be on your books at ten thousand dollars (the original purchase amount). The measurement principle states that accounting information is based on actual value and not what we think it's worth, not what it's appraised for, not what it actually cost us. So the first one we're going to talk about is what's called the measurement principle. If it doesn't follow one of these four principles, then it's really not following accounting. There are four main principles of GAAP that we follow throughout all of accounting. GAAP contains a set of accounting standards, principles, and procedures that accountants and accounting companies must follow.īack to: Accounting & Taxation What are the Types of GAAP Accounting Principles?

Generally accepted accounting principles (GAAP) is an embodiment of rules and standards that are acceptable and practiced in the accounting industry. IFRS What are Generally Accepted Accounting Principles?

#GENERALLY ACCEPTED ACCOUNTING PRINCIPLES DEFINITION UPDATE#

Update Table of Contents What are Generally Accepted Accounting Principles? Who Created GAAP? How are Generally Accepted Accounting Principles Used? GAAP vs.

0 kommentar(er)

0 kommentar(er)